Juan Salvador Agraz 40, piso 11,

Santa Fe, México, D.F. 05109.

T. + (52 55) 5246 3470

cnmc@cnmc.mx

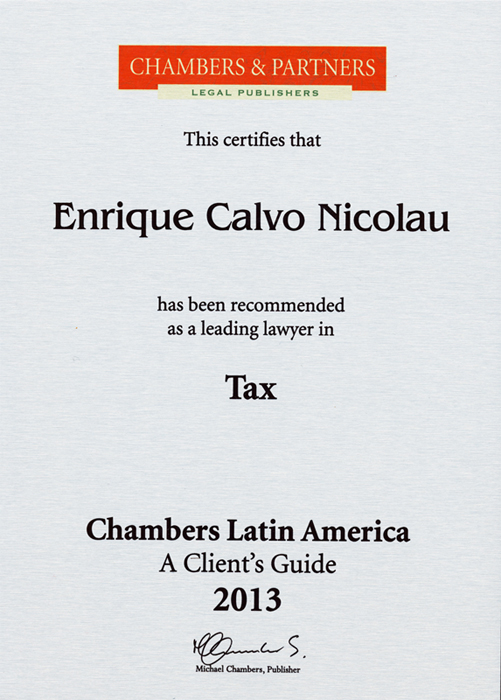

Source: www.chambersandpartners.com

All matters entrusted to the Firm go under direct supervision of both partners. Although it counts on a carefully selected team of specialists, personalized attention is fundamental for our firm. This is the Firm's quality warranty.

Advisory and analysis services encompass every tax field. The Firm works in a responsible and accurate manner in preventive actions for its clients to meet their tax obligations -both corporate and real estate- in an efficient and transparent fashion. As for the Firm experience, we may underscore its knowledge on domestic and international federal tax.

Strategic planning is essential to set goals and objectives, as well as the means to achieve the same. The Firm is in charge of analyzing the internal and external situation of its clients, and developing projects and strategies so as to set achievable and clear goals applicable to the tax field.

For individuals who have built a measurable net wealth, it is essential to arrange it so that it can be invested or distributed according to their wishes and in a tax efficient manner during their lifetime and/or following their death. It is an ongoing process and should be started as soon as the individual has accumulated a significant wealth. This is why estate tax planning becomes a very important tool to ensure preservation of an individual’s net worth. Our Firm is proficient in accomplishing such endeavour. We are aware of the need for secrecy and confidentiality while avoiding unnecessary costs through tailormade vehicles.

Our partners and staff have been trained in Mexico and abroad in this field, having extensive knowledge and management of public international law, International Conventions, Tax treaties, OECD guidelines and directives as well as rules and resolutions issued to that effect. In this way, we help our clients in the proper structuring of their businesses and investments in other countries, seeking to avoid double taxation and risks or contingencies due to their cross-border operations. In parallel, our network of associated firms abroad gives us access to specialists in tax matters at a global level in all developed countries in the world. Consequently, our firm is prepared to assist our clients in all their needs related to tax matters regarding their international operations, both from the Mexican perspective and from that of any other nation.

The partners of our firm have been involved in transfer pricing ever since the enactment of the applicable legislation in 1997. We have a solid preparation and knowledge in this field while remaining business oriented in submitting transfer pricing studies and reports required under domestic law.

We safeguard the interests of our clients by asserting their constitutional right to the administration of justice. For this reason, in the face of improper assessments from the tax authorities, we are in a position to represent our clients to defend their interests in any instance, whether it be before the tax authorities, the Court System, or the Taxpayers’ Attorney General (Prodecon).

Our firm is committed to standing for any opinion that we submit or position that is advised to our clients. This provides certainty to our clients concerning the degree of involvement and commitment by our practice.

We have solid experience and are highly regarded in handling the contentious-administrative trial, the amparo trial and even the complaint before the Inter-American Commission on Human Rights, including all stages and incidents that arise in its development.

The exercise of powers of verification by the tax authority demands that taxpayers serve and meet, in a timely and complete manner, the authorities' requirements. For this reason, the Firm assists its clients with the paperwork to fulfill said requirements, thus seeking to conclude the administrative act without bothering the taxpayer and, if any, establishing the grounds for a successful defense or litigation.

In Mexico there are no specialists in the field of criminal tax law; therefore, we pride ourselves on being one of the firms with the deepest understanding of the areas of taxation that provides consulting and defense services in tax evasion crimes, along with the best criminal defense lawyers in the country.

A solid M&A practice requires deep knowledge of accounting, project finance, taxes and applicable legislation. Our firm comprises well acquainted and reputed CPA’s (all certified for purposes of USMCA) and attorneys, consultants and litigators. This, alongside thorough experience in the field, makes us a top alternative during M&A processes, privileging tax efficiency while minimizing exposure to liabilities or risks.

The sale, transfer or disposition of stock and/or shares, as part of the sale or restructure of a business, has significant tax implications that demand attention. Particularly, in the case of individuals and non-Mexican residents, it may be necessary and/or efficient that a certified public accountant reviews and certifies the tax implications of such operations. Our firm has a long history, experience and impeccable reputation in this field.

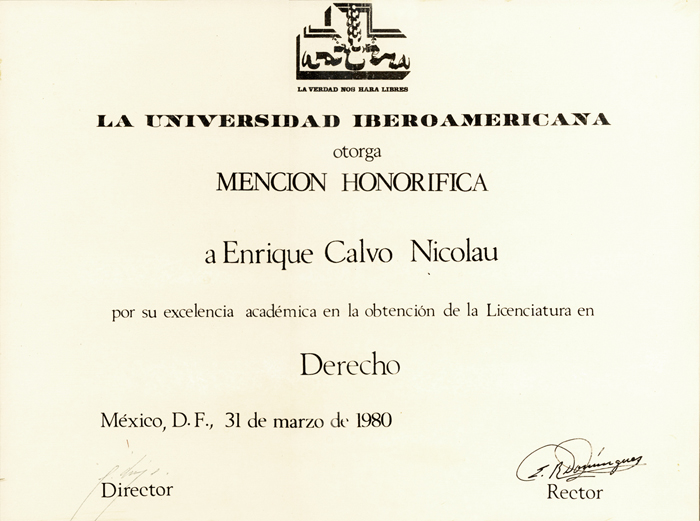

Education:

He received his Accounting degree from Universidad Nacional Autónoma de México (1964) and his Law degree from Universidad Iberoamericana (1978).

Experience:

More than 46 years of experience as tax specialist, and around 32 years in the professional practice of tax litigation.

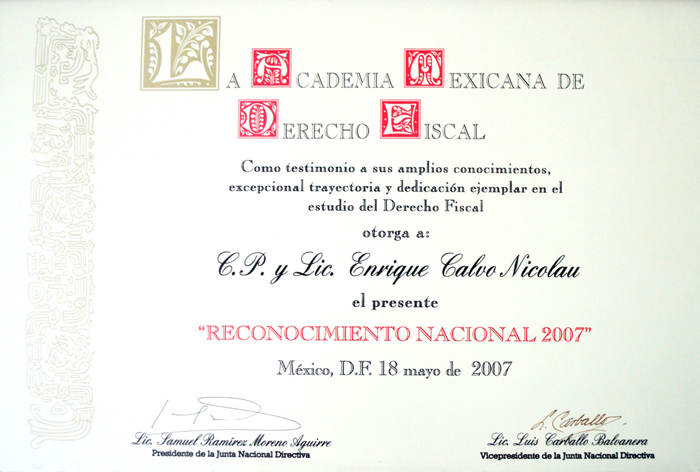

Recognitions:

In 2013 he was recipient of the National Jurisprudence Award, granted annually by the Barra Mexicana, Colegio de Abogados (Mexican Bar Association).

In 2007 the Academia Mexicana de Derecho Fiscal awarded him the 2007 National Award.

Chambers & Partners, Legal Publishers, a firm established in London, England, has named him Senior Statesman in tax matters for five consecutive years. In other words, he is considered to be the most prestigious and experienced tax specialist in Mexico.

Designated as honorary (lifelong) academic in the Tax Studies Academy (July 2015)

Organizations:

Member of the Mexican Bar Association and the Academia de Estudios Fiscales de la Contaduría Pública.

Publications:

He is acknowledged one of the most prolific Mexican authors in fiscal matters. Click here if you want to know more about his publications..

Download a full version of Enrique Calvo Nicolau's resume.

Education:

He received his accounting degree from Universidad Iberoamericana (1985) and his law degree from Universidad del Valle de México (2011).

He obtained the International Tax Certificate at the International Bureau of Fiscal Documentation in Amsterdam, Holland; completed the ITAM-Harvard program in International Tax and the AD-2 Top Management Program at IPADE (2008).

Experience:

More than 32 years of experience as tax specialist, particularly in the areas of consultancy, analysis of tax efficiency and transfer pricing. He is director of some of the most outstanding corporations in the country.

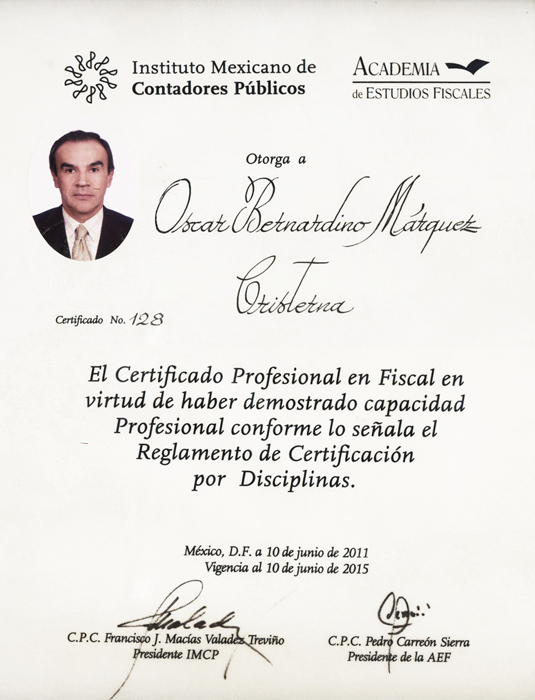

Organizations:

He is part of Academia de Estudios Fiscales de la Contaduría Pública, Instituto Mexicano de Contadores Públicos and Colegio de Contadores Públicos de México. In addition, he has held honorary positions such as: member of the National Commission of Tax Matters of COPARMEX and Government Vicepresident of the Colegio de Contadores Públicos de México, among others.

Chairman of the Tax Studies Academy (2015-2017)

Vice chairman for the Americas in DFK International Tax Committee

Publications:

In 2003 he published Los Derechos Adquiridos y otros Aspectos de Ilegalidad en la Derogación del Régimen Simplificado de las Personas Morales (Editorial Themis). In 2013 he edited his book El Outsourcing a través de Sindicatos, by the same publishing house.

Click here if you want to know more about his publications.

omarquez@cnmc.mx

Education:

Graduated from the Law School of Universidad del Valle de México (1997), he has completed Postgraduate Programs in Intellectual Law at Ilustre y Nacional Colegio de Abogados de México (2002), in Taxes at Academia Mexicana de Derecho Fiscal (2003) and a Diploma program in Amparo Actions at Instituto Tecnológico Autónomo de México (2006).

Experience:

With 25 years of experience in Tax, Administrative and Amparo Law, he has been an associate at Calvo Nicolau y Márquez Cristerna, S.C. since 2010.

Organizations:

Member of the Mexican Association Bar.

Education:

- Certified Public Accountant graduated from Instituto Tecnológico Autónomo de México in 1990.

- Diploma in Corporte Law - Instituto Tecnológico Autónomo de México.

- Diploma in International Taxation - Harvard and Instituto Tecnológico Autónomo de México.

Experience:

- 1991-November 2015 - Chevez, Ruiz, Zamarripa y Cia., S.C. Firm specialized in tax consulting and advisory services.

- 1989-1991 - Audit Department at Ruiz, Urquiza y Cía., S.C. representative in México of Arthur Andersen & Co.

- Professor of various graduate and undergraduate tax courses at Instituto Tecnológico Autónomo de México for the period 1992-2012.

- Speaker in tax matters in several national and international seminars.

Organizations:

- Member of the Academia de Estudios Fiscales de la Contaduría Pública (Academy of studies in tax matters) since 1999, being President of said organization for the period 2013-2015.

- Member of the Mexican Institute of Public Accountants.

- Former member of the Governing Committee of the College of Public Accountants.

- Member of the International Tax Committee of the College of Public Accountants.

Publications:

- Author of the books “Descripción y Análisis Crítico de la Consolidación Fiscal en 1999” and “Alcance de los términos “Beneficios Empresariales” y “Otras Rentas” en los convenios para evitar la doble imposición”, published by Editorial Themis as part of the Collection of Academic Tax Studies.

Education:

Public Accountant graduated from Instituto Tecnológico Autónomo de México in 2009, she has completed a Master’s Degree in Taxes in Universidad Panamericana (2015-2016).

Experience:

With 10 years of experience in Tax, she was promoted to associate of Calvo Nicolau y Márquez Cristerna-DFK, S.C. in 2017.

He is lawyer from the Escuela Libre de Derecho (2008) and a Master in Business Law from the Universidad Panamericana (2019). He has 13 years of experience in legal advice and defense of companies, both as in-house lawyer and in specialized firms.

He works in the areas of tax and administrative litigation, as well as legal-tax consulting.

Tax efficiency in an organization must begin with the availability of reliable and timely financial information. This is achieved only if prepared in accordance with the financial information standards issued by Consejo Mexicano para la Investigación y Desarrollo de Normas de Información Financiera A.C. (CINIF). This ensures that all financial statements comply with basic provisions in terms of information and become useful tools for decision making.

Moreover, organizations need to have an appropriate results projection process. Their budget will enable: to forecast profits expected for a certain cycle, to recognize accrued taxes and to adopt necessary measures to make tax resources available more efficient.

In this task, the knowledge and accurate use of tax concepts by financial executives or officers of corporations is essential; this means knowing and understanding the general premises taxes to be paid are based on, especially Income Tax and Value Added Tax. The clearer the knowledge available, the lesser tax contingencies. Likewise, finance departments in corporations should be generally aware of the opportunities offered by tax laws to taxpayers, so as to increase the business profitability.

Finally, it is important to have the support of specialists in the field so that, based on their projections and financial information available, they may advise the company in the prospecting to determine their taxes in the most efficient way possible.

The execution of every work requires foresight, in the first instance, which means anticipating to the occurrence of the facts. Secondly, after identifying and determining the same, we resort to planning, which enables linking decisions and necessary measures to foresight for the organization to meet the objectives and achieve the goals set.

In financial terms, planning is achieved through budgets and projections, concepts to which all tax aspects are related. The process of foreseeing tax effects in a corporation's transactions is precisely tax planning; the more well-prepared the process is, the more objectives leading to reducing taxes in organizations may be set to achieve higher profitability. Clearly, this process includes fully complying with the effective legal framework, ethical and social liability principles, which must be present among every director and top officer of corporations.

In sum, tax planning is a process to forecast the burdens to be paid by an organization as a results of the activities or transactions conducted. The aforementioned foresight and planning processes enable to identify the advantages available to reduce the tax burden, without breaching the effective regulatory framework. Tax planning allows optional economy and tax avoidance. However, this excludes harming practices such as simulation of legal acts and tax evasion.

These are the values used to transfer goods or services among corporations part of the same group or related to one another. In other words, they are the considerations agreed among related corporations, in exchange for obtaining certain goods or services offered among them.

Transfer prices deserve special analysis by tax authorities from all developed countries, even by the organism grouping said countries: the OECD. The purpose of transfer pricing is to avoid transfering profits from one company to the other or from one country to the other, to the detriment of tax collection in a certain jurisdiction.

In Mexico, they are grounded in Chapter II, Title VI, of the Income Tax Law, and are applied on practically all entities or persons performing business activities.

It is worth mentioning that the existing provisions in transfer pricing matters are applicable both to national (also called "domestic") and international transactions.

The new Tax Integration Regime set forth in the Income Tax Law, as of 2014, is only applicable to the following: individuals with commercial activities, individuals alienating goods or delivering services for which they do not need a professional degree, and only should the income for commercial activities of the immediately preceding fiscal year does not exceed two million pesos. In general, they may choose this tax paying regime without prejudice of obtaining income for other concepts or activities throughout the fiscal year. However, the law sets forth the following exception, which, should they fall within the scope, prevents the person from paying taxes as per this special regime.

If the income of individuals is generated from commercial activities consisting in public shows, they are excluded from the special regime. It also excludes individuals whose commercial activities are carried out through trusts or partnerships, or if they are generated from commission, mediation, agency, representation, brokerage, allocation and distribution.

This special regime excludes as well individuals who, in addition to obtaining income from commercial activities or providing non-professional services, perform activities related to real estate, real estate capital, real estate business or financial activities.

Likewise, it excludes individuals who are partners, shareholders or members of entities or related parties or related to persons who have paid taxes under the Tax Integration Regime.

Nevertheless, despite the tax provision in question, tax authorities by means of the Miscellaneous Resolution -apparently beyond the law- prevent people from paying taxes under this regime if the amount of their income due to commercial activities, plus their salaries, similar wage concepts or interests, exceeds the amount of two million pesos in the fiscal year.